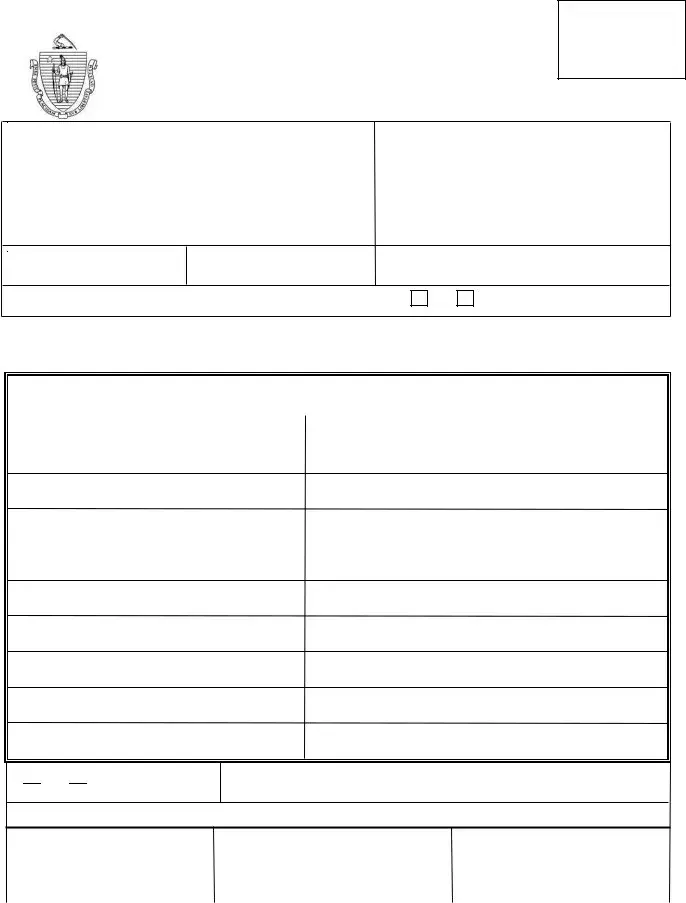

Fill in a Valid Massachusetts 127 Form

The Massachusetts 127 form is a document used to calculate the average weekly wage for employees who have sustained work-related injuries. This form is essential for ensuring that injured workers receive the appropriate compensation based on their earnings prior to the incident. Proper completion of the form helps streamline the claims process and supports fair treatment for all parties involved.

Fill Out Form

Fill in a Valid Massachusetts 127 Form

Fill Out Form

This form needs one last touch

Finish your Massachusetts 127 online with quick edits and instant download.

Fill Out Form

or

Download Massachusetts 127 PDF Form

Yes

Yes

No

No